The COVID-19 pandemic has affected Americans in many ways, and mental health employee benefits takes aim at helping workers who struggle with mental health. Before the pandemic, it was reported that about 5% of employed workers reported poor or very poor mental health – that number has since risen to 18% of employed workers struggling […]

-

New Study Finds Florida has Most Expensive Hospitals in the Country

In a new study by National Nurses United, Florida was found to have the most expensive hospitals in the country. This outcome was determined by the hospitals’ charge-to-cost ratios, and 40 Florida hospitals came in amongst the top 100 most expensive – the highest number of hospitals in any state. With COVID-19 cases surging in […]

-

2021 Benefits Limits to Know

As we enter the 2021 plan year, it is important to review some of the many benefit plan limit changes for the new calendar year. 401(k) Limits Pre-tax contributions: $19,500 (no change from 2020) Catch-up contributions: $6,500 (no change from 2020) Health Savings Account (HSA) Limits Pre-tax contributions Single coverage: $3,600 (up $50 from 2020) […]

-

HR Florida 2020

We had a great time exhibiting/sponsoring at the HR Florida Conference & Expo this year. If you couldn’t make it to our physical or virtual booth this year, we sure did miss you ! We would still like to offer you an opportunity to get two years free on our Learning Management System (LMS) – […]

-

5 Ways COVID-19 is Reshaping HR

Coronavirus (COVID-19) guidance has been changing continuously, and HR have been tasked with doing everything they can do adapt quickly to these new challenges. We’ll take a look into five ways the coronavirus is reshaping HR and how departments can adapt to these new challenges: 1. Greater Remote Working Opportunities The initial shutdown of nonessential […]

-

WEBINAR: COVID-19 Dashboard

In this COVID Webinar: A live demonstration on how Paycor is providing HR leaders with the technology and expertise to help them prepare, respond and recover. The demonstration will highlight how Paycor Analytics and HR Support Center can offer the data and resources HR leaders need to mitigate risk and reshape business strategy. The decisions […]

-

2020 Benefit Plan Limits

Many benefit plan limits have changed for the new calendar year. The limits for 2020 are below: 401 (K) Limits Pre-tax contributions: $19,500 (up $500 from 2019) Catch-up contributions: $6,500 (up $500 from 2019) Health Savings Account (HSA) Limits Pre-tax contributions: Single coverage: $3,550 (up $50 from 2019) Family coverage: $7,100 (up $100 from 2019) […]

-

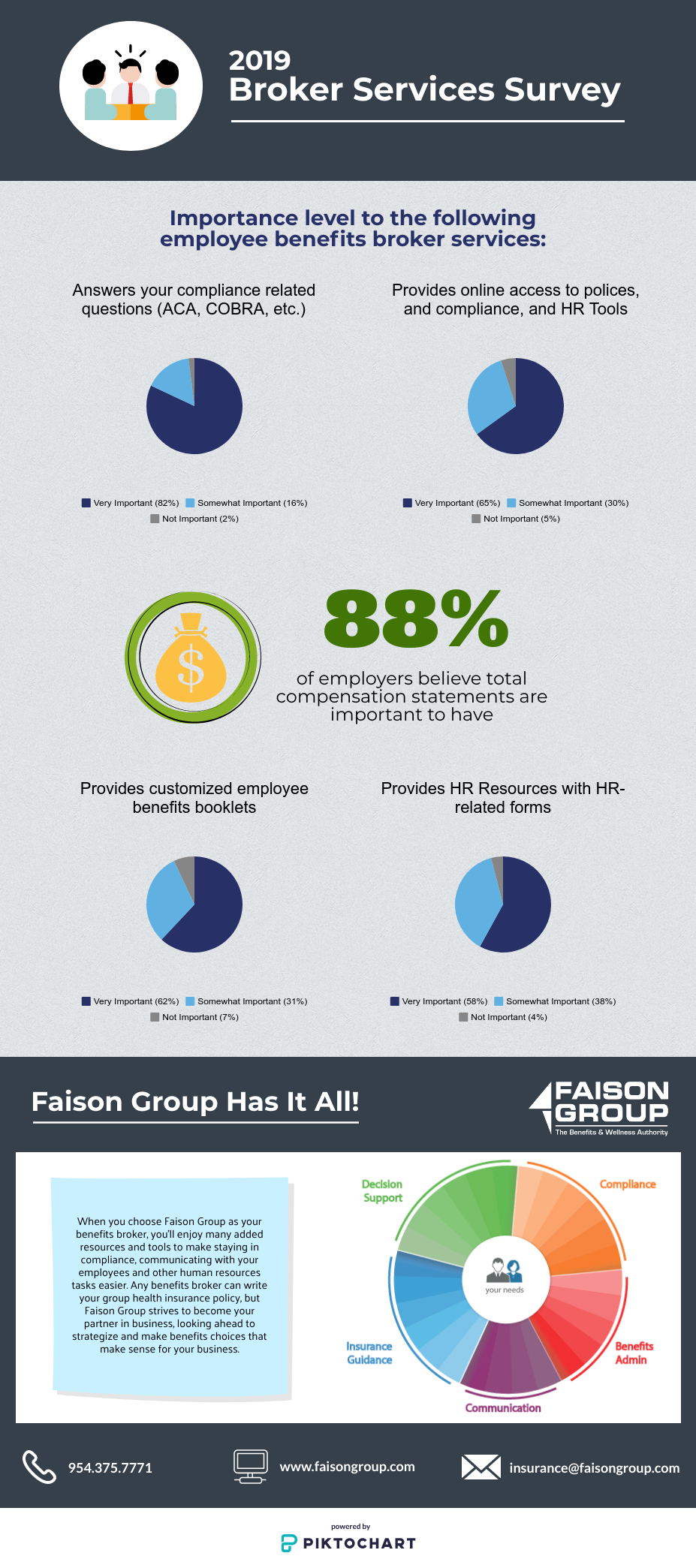

Benefits of Total Compensation Statements

Though your benefits package may be quite substantial, your employees may not know it or may not understand some of the benefits you offer. Helping employees understand their total compensation can raise morale and may increase loyalty to your company. To assist your employees in fully comprehending their benefits package, consider providing a total compensation […]

-

HSA Limits for 2020

Each year the IRS announces inflation-adjusted limits for health savings accounts (HSAs) and high deductible health plans (HDHPs). The limits affected include: The maximum HSA contribution limit The minimum deductible amount for HDHPs The maximum out-of-pocket expense limit for HDHPs. Each limit varies based upon whether an individual as self or family coverage. In 2020, […]

-

Pros and Cons of Reference-Based Pricing

With health care costs continuing to rise, employers are seeking new options to lower expenses. One strategy that has recently emerged is Reference-Based Pricing (RBP). This pricing enables you to choose the best option for your health and budget, while illuminating potentially unnecessary costs. How does Reference-Based Pricing Work? RPB works by setting spending limits […]